(Image source from: financialexpress.com)

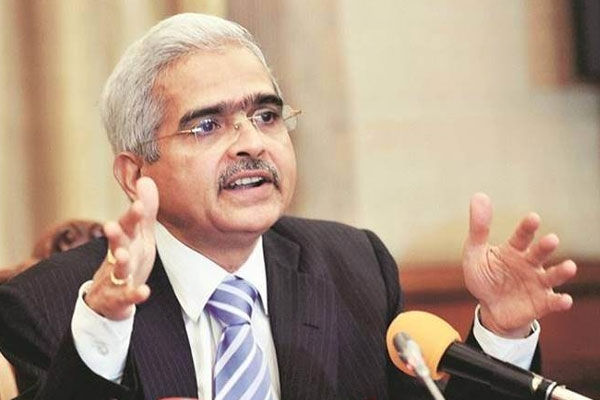

In the press briefing that happened at 10 in the morning, RBI Governor, Shaktikanta Das revealed some of the quintessential measures that RBI is taking in helping people battle this Covid-19 outbreak.

Out of them all, the one that stood out was the fact that the apex bank has cut down the reverse repo rate from 4% to 3.75%. The repo rate, on the contrary, remains the same.

Following that, Das also clarified saying that the 90-days NPA norm will not be applicable to the moratorium granted on the bank loans in the country.

Das mentioned that the banks will not be making any further dividend payment in the view of the coronavirus crisis that has been happening around.

In addition to that, the LCR requirement of the bank has also been brought down to 80% from 100% this time around. The same is going to be restored in gradual phases in the upcoming year.

The conference also mentioned that the loans given by the NBFCs to majority of the real estate companies will experience similar benefits as given by that of the commercial banks.

Highlighting that further, Das stated saying, “The ways and means limit of the States have been raised to help them, not to bunch up their borrowing plans.”

Das said that all these new measures that are being taken up by RBI are done to maintain adequate liquidity in the system, ease the consistent financial stress and even facilitate the bank credit flow.

He emphasised the crucial situation of the lockdown that has brought the entire economy of the country to a standstill.

“LTRO-2.0 will involve Rs 50,000 crore to begin with. Rs 50,000 crore special finance facility will be provided to financial institutions such as NABARD, SIDBI and NHB,” Das stated.

The increase in the surplus liquidity in the banking system was another factor that was worth taking a look into. The same has been done because of the actions taken by the central bank.

Das reported that the contraction in the exports in March went down by 34.6% which is worse than the financial crisis that happened back in 2008-09.

Das further stated saying, “Automobile production and sales have declined sharply in March. Electricity demand has fallen sharply. The impact of Covid-19 has not been captured in the IIP data for February.”

The IMF projections of the GDP growth of India by 1.9% are the highest among all the other G20 countries across the globe. Das also lauded the efforts put in by the banks and the financial institutions during this time of crisis to ensure normal bank functioning amid the lockdown.

Das also assured that RBI is consistently monitoring the situation and is going to come up with everything in their power to mitigate the backlash that the country receives amidst the coronavirus outbreak.

This was the second time that the RBI governor addressed the nation following his conference on March 25 where he announced the EMI moratorium for the coming three months and a few other pointers.

By Somapika Dutta